Self Build Advice: 13 – VAT Reclaim

Categories: Self Build Advice

Once the building of your home has been completed you’ll need to contact your local authority to arrange for a council tax valuation, a warranty inspector will review the property and issue the warranty, and you can now switch your self-build site insurance to a homeowners’ policy. It’s also time to embark on the VAT reclaim process.

Under current government legislation, there’s no Value Added Tax (VAT) on new houses. Therefore, the authorities enable self-builders to reclaim any VAT paid on construction materials purchased for their new home during the build at the end of the project.

Below we have compiled a summary of useful information and advice on this process:

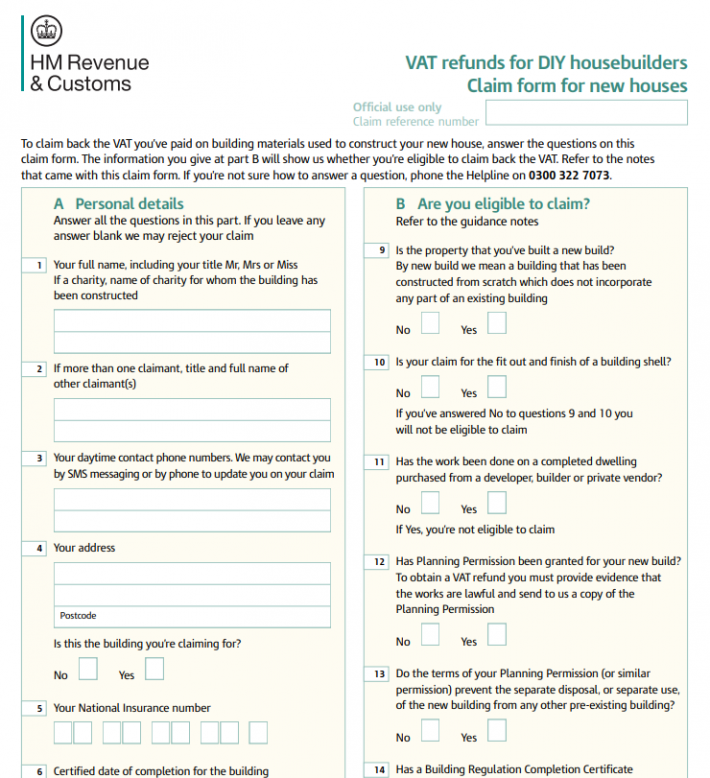

- What To Do: There is no need to register for VAT, but your claim must be submitted within three months of finishing the build and receiving Building Control sign off. You will need to provide proof that your house has been finished therefore you will require a completion certificate from Building Control. To claim you must fill in forms provided by the Customs & Excise VAT office on the gov.uk website. Once your claim has been submitted it will usually be processed within a month, provided you keep to the procedures they set out, submit your claim on time with all invoices properly listed, and answer any questions promptly. Make enquiries if you do not receive an acknowledgement within 14 days. You can make one claim only.

- Keep Organised: All invoices and receipts should be made out to you personally as the self-builder and it is essential to keep all your financial paperwork in good order from an early stage in the project. You’ll need to keep all the invoices and records which you will later require to complete your claim, so file everything carefully and examine each bill that comes in to ensure it is addressed accurately and shows the VAT element correctly. Keep copies of everything and ensure you send paperwork via recorded post. It is worth doing as the value of the refund could be quite substantial.

- Inclusions / Exclusions: Beware of paying VAT in error as this cannot be reclaimed later as part of your DIY refund. VAT is payable on materials, it is not payable on labour only or on ‘supply and fix’ contracts. VAT will be charged for the supply of materials only, but you can reclaim this. If you employ a main contractor to undertake the build for you, then they will reclaim the VAT paid on materials supplied, and so the invoices to you should be zero-rated. If you project manage the build yourself and use sub-contractors who ‘supply and fix’, VAT should not be charged, but you will be required to pay VAT on construction materials that you buy yourself which can be reclaimed at the end of the project. If you open your own trade account, you may be able to purchase materials as zero-rated, but you should check with them first. Items that you could remove from the finished property should you move house (for example cookers, washing machines, refrigerators etc), are not claimable for the VAT paid on them. However, if the material becomes part of the essential fixtures of the house then you can reclaim the VAT. You cannot reclaim on the hire of tools or equipment, including skips and temporary fencing. You cannot reclaim the VAT on professional services, such as architect or surveyor fees. Your claim can include VAT paid in respect of boundary walls, drives, patios etc. provided these are built at the same time as the main dwelling. Therefore, it may make sense to delay the official completion of your home and the subsequent submission of your VAT reclaim until all landscaping work has also been finished. If you are building the home for your own occupation you can use the VAT reclaim scheme, if however, you are constructing the house with the sole intention of selling or letting it, you cannot use the scheme.

Important note – you may require your approved VAT claim to use as evidence of your Self Build Exemption for the Community Infrastructure Levy (CIL). You’ll need to complete CIL form 7 part 2 within 6 months of finishing the build.

Comments are closed.